Xylem: Fund Managers Like This excellent ESG-Rated stock

llucky78

regularly, investors face a change-off between stocks which are environmentally sound and those that promise decent rewards. In Xylem Inc. (NYSE:XYL), they have a reputation with excessive ESG rankings and low in cost boom.

About Xylemit's a world water expertise enterprise that designs, manufactures, and services "particularly engineered items and options throughout a wide selection of essential purposes, basically within the water sector, however also in energy."

In its 10-okay for 2022, it additionally tells investors that it has a "broad portfolio of products, features and options to addresses consumer needs of shortage, resilience, and affordability throughout the water cycle, from the beginning, measurement and use of consuming water, to the assortment, checking out, analysis and medicine of wastewater, to the return of water to the ambiance."

These are just a few of the items featured on the domestic page of its website:

XYL water products (enterprise presentation)

The enterprise expanded dramatically in 2023 when it purchased Evoqua Water technologies Corp., in an all-stock transaction value about $7.5 billion. In asserting the completion of the deal in a may 24 press unlock, the business noted, "the combined business turns into the world's largest pure-play water technology business, with $7.three billion in seasoned forma revenue and more than 22,000 employees globally."

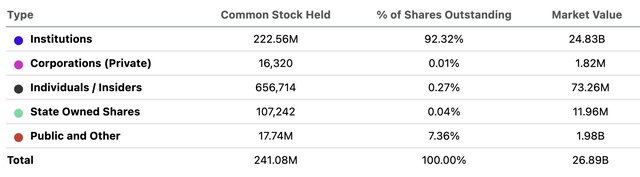

Institutional investorsInstitutional investors are commonly fund managers with giant swimming pools of capital to make investments on behalf of pension, mutual, and hedge cash, in addition to banks, assurance businesses and other entities that compile dollars for funding.

As this excerpt from the possession component to the Xylem abstract page at looking for Alpha shows, institutional investors, which can be above all fund managers, cling just about the entire business's shares:

XYL ownership table (SeekingAlpha)

The three largest institutional holdings, based on Nasdaq.com, are three fund giants: the leading edge community Inc., BlackRock, Inc. (BLK), and State street business enterprise (STT). on the conclusion of Q3-2023, 1,345 fund managers held Xylem inventory.

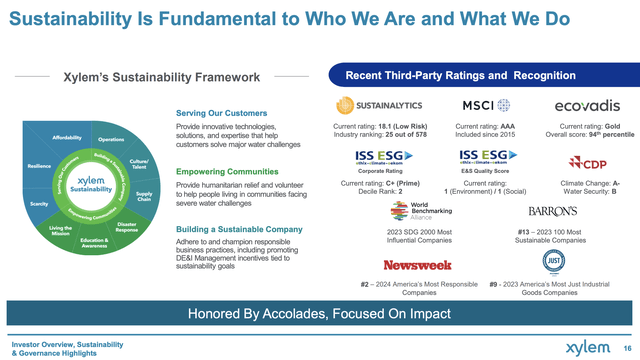

ESG CredentialsXylem is among the many highest-rated establishments as assessed by using many sustainability-rating services. The business highlighted a few of them during this slide from its January 2024 investor presentation:

XYL sustainability rating rankings (business presentation)

In its annual Sustainability record for 2022, the company said growth on a couple of of its desires, including:

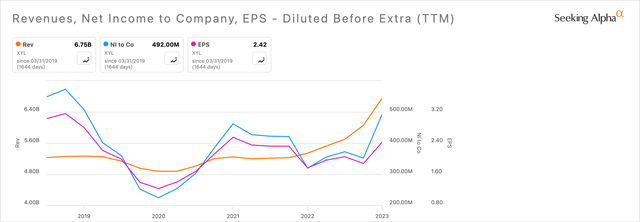

First, the enterprise's salary, internet income, and profits per share were recovering from the slump that all started within the fourth quarter of 2021:

Chart showing XYL salary and net income (SeekingAlpha)

2nd, these beneficial properties had been gigantic. On a TTM year-over-yr groundwork, profits is up 26.forty seven%, EBITDA increased 37.47%, salary from operations won 54.23%, and diluted profits per share rose 37.44%.

at the same time, margins proceed to be okay, with the TTM gross margin at 37.fifty nine%, TTM EBITDA margin at 16.57%, and the TTM internet profits margin at 7.29%.

Third, return on usual fairness, at 7.49%, is well under the Industrials sector median of 12.17%. similarly, the return on total capital and return on complete assets lags the field medians.

searching ahead, the company has purpose to be positive. in the U.S., the Infrastructure investment and Jobs Act of 2021 gives a complete of $1.2 trillion in funding for all sorts of infrastructure.

Of that amount, more than $50 billion will go into drinking water, wastewater, and stormwater infrastructure. Some would say it really is a great start, but nevertheless just a delivery. The American Society of Civil Engineers gives the nation's drinking water, stormwater, and wastewater infrastructure grades of C-, D, and D+, respectively.

It goes on to quote the Environmental protection company as announcing these three sorts of water infrastructure need greater than $743 billion in funding. and that's the reason simply the federal government; states and other nations also want new or superior water infrastructure.

there is another tailwind, of route, which is the continued decline in interest prices. each time charges drop a point or sometimes even a fraction of a point, more shelved projects turn into possible.

in keeping with the basics, Xylem is well-placed to grow over the next decade.

Demand for ESG sharesESG stands for Environmental, Social, & Governance and refers to a set of requirements that may assist socially conscious buyers reveal their investments. as well as taking a look at a corporation's environmental record, it takes in social issues reminiscent of a firm's relationship with the communities inside which it operates. Governance refers to how ethically the business is managed.

until lately, ESG became often seen as a fringe investing approach, but in recent years demand has grown. Fund managers now pursue ESG shares to hold their individual and institutional valued clientele convinced.

based on PwC's Asset and Wealth administration Revolution 2022 document, "ESG-oriented AuM is set to grow at a an awful lot faster pace than the AWM [Asset & Wealth Management] market as a whole."

How tons faster? PwC says, "With a projected compound annual growth rate (CAGR) of 12.9%, ESG assets are on pace to constitute 21.5% of complete international AuM in lower than 5 years. It represents a dramatic and carrying on with shift in the asset and wealth administration [AWM] trade".

As for sacrificing returns for socially conscious investments, PwC says that is now not the case. It mentioned that nine out of ten asset managers surveyed believe ESG integration will improve usual returns. And, 60% of institutional traders surveyed talked about that ESG investing had already delivered better efficiency yields when compared to non-ESG equivalents.

So, fund managers and others deserve to discover ESG corporations, and Xylem is likely one of the foremost. because the Sustainability slide above shows:

The different scores on that page have in a similar way excessive ranges.

All of which capability demand for ESG shares is rising, and again, Xylem is neatly-positioned to be one among them.

Valuationat first look, the company's stock seems puffed up. forward P/E Non-GAAP is 29.eighty five, which is basically 60% better than the field median of 18.17.

although, after we element in the growth of revenue, the current valuation looks extra competitively priced. The ahead PEG Non-GAAP is 1.23, which is within the reasonable-Valuation range however nevertheless costlier than the field median of 0.84.

My center of attention on valuation, notwithstanding, exceptionally goes to the profits estimates, which can be as follows:

all over 2023, earnings are expected to raise 30.95%. If we add that volume to the December 30, 2022 share price ($a hundred and ten.57 + 30.ninety five%), we arrive at a share rate of $144.79.

due to the fact the December 29, 2023, rate turned into $114.36, then i go to argue that Xylem turned into undervalued as we entered 2024. extra specifically, it became undervalued by means of $30.43, or that it has a 26.61% margin of protection.

the use of the same procedure from the end of 2023 to the conclusion of this 12 months, I are expecting a share fee of ($114.36 + 9.00%) $124.65 at the end of 2024. further expense projections are possible, however with a lesser degree of confidence.

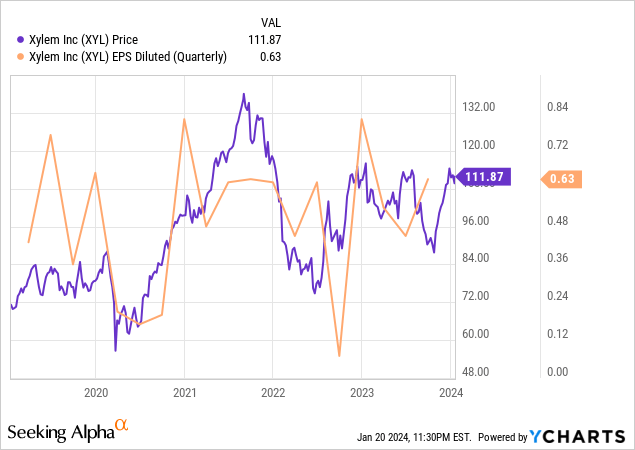

and how has the share fee boom tracked income growth over the past five years? no longer perfectly, but perhaps moderately:

statistics with the aid of YCharts

statistics with the aid of YCharts

My challenge about risk is tempered just a little by way of the reality so many fund managers personal the stock, given they've many extra components than the relaxation of us to investigate dangers and rewards. nevertheless, there are a number of possibility elements that deserve our consideration:

There are two first rate motives for the potent institutional investor pastime in Xylem Inc. It is likely one of the optimum-rated ESG shares obtainable, and it appears poised to increase its fundamentals over the next three to five years.

I trust its shares to be undervalued in view that the share expense is close to the place it become on the end of 2023. And, I expect the proportion fee to gain 9.00% over 2023's closing expense. With these standards, i'm giving Xylem a purchase rating.

Comments

Post a Comment