The bulls and bears in Voltamp: right here is how mutual fund holdings stack up at the moment

September 26, 2023 / 02:40 PM IST

The administration is still positive on the business outlook due to steady increase in home demand from metals, statistics centres, eco-friendly power, pharma, automobiles, and so forth, say analysts '); $('#lastUpdated_'+articleId).text(resData[stkKey]['lastupdate']); //if(resData[stkKey]['percentchange'] > 0) // $('#greentxt_'+articleId).removeClass("redtxt").addClass("greentxt"); // $('.arw_red').removeClass("arw_red").addClass("arw_green"); //else if(resData[stkKey]['percentchange'] < 0) // $('#greentxt_'+articleId).removeClass("greentxt").addClass("redtxt"); // $('.arw_green').removeClass("arw_green").addClass("arw_red"); // if(resData[stkKey]['percentchange'] >= 0) $('#greentxt_'+articleId).removeClass("redtxt").addClass("greentxt"); //$('.arw_red').removeClass("arw_red").addClass("arw_green"); $('#gainlosstxt_'+articleId).discover(".arw_red").removeClass("arw_red").addClass("arw_green"); else if(resData[stkKey]['percentchange'] < 0) $('#greentxt_'+articleId).removeClass("greentxt").addClass("redtxt"); //$('.arw_green').removeClass("arw_green").addClass("arw_red"); $('#gainlosstxt_'+articleId).locate('.arw_green').removeClass("arw_green").addClass("arw_red"); $('#volumetxt_'+articleId).show(); $('#vlmtxt_'+articleId).show(); $('#stkvol_'+articleId).textual content(resData[stkKey]['volume']); $('#td-low_'+articleId).text(resData[stkKey]['daylow']); $('#td-high_'+articleId).text(resData[stkKey]['dayhigh']); $('#rightcol_'+articleId).reveal(); }else $('#volumetxt_'+articleId).conceal(); $('#vlmtxt_'+articleId).hide(); $('#stkvol_'+articleId).textual content(''); $('#td-low_'+articleId).textual content(''); $('#td-high_'+articleId).text(''); $('#rightcol_'+articleId).conceal(); $('#stk-graph_'+articleId).attr('src','//appfeeds.moneycontrol.com/jsonapi/stocks/graph&layout=json&watch_app=real&latitude=1d&category=area&ex='+stockType+'&sc_id='+stockId+'&width=157&peak=100&source=web'); } } } }); } $('.bseliveselectbox').click(characteristic() $('.bselivelist').display(); ); characteristic bindClicksForDropdown(articleId) $('ul#stockwidgettabs_'+articleId+' li').click on(characteristic() stkId = jQuery.trim($(this).discover('a').attr('stkid')); $('ul#stockwidgettabs_'+articleId+' li').discover('a').removeClass('lively'); $(this).locate('a').addClass('active'); stockWidget('N',stkId,articleId); ); $('#stk-b-'+articleId).click(characteristic() stkId = jQuery.trim($(this).attr('stkId')); stockWidget('B',stkId,articleId); $('.bselivelist').cover(); ); $('#stk-n-'+articleId).click on(function() stkId = jQuery.trim($(this).attr('stkId')); stockWidget('N',stkId,articleId); $('.bselivelist').cover(); ); $(".bselivelist").focusout(function() $(".bselivelist").conceal(); //disguise the results ); characteristic bindMenuClicks(articleId) $('#watchlist-'+articleId).click on(characteristic() var stkId = $(this).attr('stkId'); overlayPopupWatchlist(0,2,1,stkId); ); $('#portfolio-'+articleId).click on(feature() var dispId = $(this).attr('dispId'); pcSavePort(0,1,dispId); ); $('.mc-modal-close').on('click on',characteristic() $('.mc-modal-wrap').css('screen','none'); $('.mc-modal').removeClass('success'); $('.mc-modal').removeClass('error'); ); feature overlayPopupWatchlist(e, t, n,stkId) $('.srch_bx').css('z-index','999'); typparam1 = n; if(readCookie('nnmc')) var lastRsrs =new Array(); lastRsrs[e]= stkId; if(lastRsrs.size > 0) var resStr=''; let secglbVar = 1; var url = '//www.moneycontrol.com/mccode/standard/saveWatchlist.Hypertext Preprocessor'; $.get( "//www.moneycontrol.com/mccode/normal/rhsdata.html", characteristic( records ) $('#backInner1_rhsPop').html(records); $.ajax(url:url, category:"post", dataType:"json", data:q_f:typparam1,wSec:secglbVar,wArray:lastRsrs, success:function(d) if(typparam1=='1') // rhs var appndStr=''; //var newappndStr = makeMiddleRDivNew(d); //appndStr = newappndStr[0]; var titStr='';var editw=''; var typevar=''; var pparr= new Array('Monitoring your investments continually is important.','Add your transaction particulars to monitor your stock`s efficiency.','which you can additionally tune your Transaction heritage and Capital beneficial properties.'); var phead ='Why add to Portfolio?'; if(secglbVar ==1) var stkdtxt='this inventory'; var fltxt=' it '; typevar ='inventory '; if(lastRsrs.length>1) stkdtxt='these shares'; typevar ='shares ';fltxt=' them '; //var popretStr =lvPOPRHS(phead,pparr); //$('#poprhsAdd').html(popretStr); //$('.btmbgnwr').reveal(); var tickTxt =''; if(typparam1==1) var modalContent = 'Watchlist has been updated effectively.'; var modalStatus = 'success'; //if error, use 'error' $('.mc-modal-content material').textual content(modalContent); $('.mc-modal-wrap').css('reveal','flex'); $('.mc-modal').addClass(modalStatus); //var existsFlag=$.inArray('added',newappndStr[1]); //$('#toptitleTXT').html(tickTxt+typevar+' to your watchlist'); //if(existsFlag == -1) // // if(lastRsrs.length > 1) // $('#toptitleTXT').html(tickTxt+typevar+'already exist to your watchlist'); // else // $('#toptitleTXT').html(tickTxt+typevar+'already exists on your watchlist'); // // //$('.accdiv').html(''); //$('.accdiv').html(appndStr); , //finished:characteristic(d) // if(typparam1==1) // // watchlist_popup('open'); // // ); ); else var disNam ='inventory'; if($('#impact_option').html()=='stocks') disNam ='inventory'; if($('#impact_option').html()=='MUTUAL money') disNam ='mutual fund'; if($('#impact_option').html()=='COMMODITIES') disNam ='commodity'; alert('Please choose as a minimum one '+disNam); else AFTERLOGINCALLBACK = 'overlayPopup('+e+', '+t+', '+n+')'; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ feature pcSavePort(param,call_pg,dispId) var adtxt=''; if(readCookie('nnmc')) if(call_pg == "2") pass_sec = 2; else pass_sec = 1; var postfolio_url = 'https://www.moneycontrol.com/portfolio_new/add_stocks_multi.Hypertext Preprocessor?id='+dispId; window.open(postfolio_url, '_blank'); else AFTERLOGINCALLBACK = 'pcSavePort('+param+', '+call_pg+', '+dispId+')'; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ feature commonPopRHS(e) /*var t = ($(window).top() - $("#" + e).peak()) / 2 + $(window).scrollTop(); var n = ($(window).width() - $("#" + e).width()) / 2 + $(window).scrollLeft(); $("#" + e).css( position: "absolute", right: t, left: n ); $("#lightbox_cb,#" + e).fadeIn(300); $("#lightbox_cb").get rid of(); $("physique").append(''); $("#lightbox_cb").css( filter: "alpha(opacity=80)" ).fadeIn()*/ $(".linkSignUp").click(); function overlay(n) doc.getElementById('back').trend.width = doc.physique.clientWidth + "px"; document.getElementById('returned').vogue.top = document.body.clientHeight +"px"; document.getElementById('again').style.display = 'block'; jQuery.fn.core = function () this.css("position","absolute"); var topPos = ($(window).height() - this.peak() ) / 2; this.css("exact", -topPos).display().animate('true':topPos,300); this.css("left", ( $(window).width() - this.width() ) / 2); return this; setTimeout(feature()$('#backInner'+n).middle(),one hundred); feature closeoverlay(n) document.getElementById('back').trend.reveal = 'none'; doc.getElementById('backInner'+n).style.reveal = 'none'; stk_str=''; stk.forEach(function (stkData,index) if(index==0) stk_str+=stkData.stockId.trim(); else stk_str+=','+stkData.stockId.trim(); ); $.get('//www.moneycontrol.com/techmvc/mc_apis/stock_details/?basic=actual&sc_id='+stk_str, feature(records) stk.forEach(function (stkData,index) $('#stock-name-'+stkData.stockId.trim()+'-'+article_id).textual content(records[stkData.stockId.trim()]['nse']['shortname']); ); ); characteristic redirectToTradeOpenDematAccountOnline() if (stock_isinid && stock_tradeType) window.open(`https://www.moneycontrol.com/open-demat-account-on-line?basic=actual&script_id=$stock_isinid&ex=$stock_tradeType&website=internet&asset_class=inventory&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, '_blank');Voltamp Transformers stock fell as a lot as 4 % after it become pronounced that the promoters offered a 12.9 % fairness stake in the business in bulk offers on September 26 for Rs 603.54 crore. On September 26, it changed into suggested that a bulk deal had taken place on both NSE and BSE, resulting in round 12.9 p.c equity in Voltamp Transformers altering palms.

while it is yet to be ascertained who the consumers are in the deal, sources had prior to now instructed CNBC Awaaz the promoters had been trying to sell a mixed 10 % stake, or 12 lakh shares, of their complete holdings via block deals.

As many as 13 lakh shares have been offered and purchased at an ordinary fee of Rs four,650, totalling Rs 603.fifty four crore.

additionally read: Voltamp Transformers drops 6% after Rs 603 crore block deal; promoter probably seller

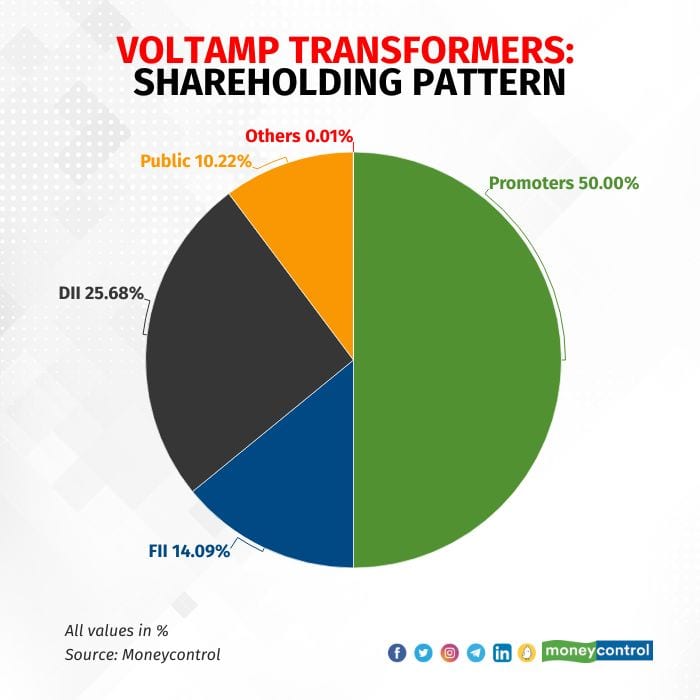

How Voltamp shareholding stacks up

As of June 2023, the promoters held round 50 p.c stake within the Oil stuffed energy and Distribution Transformers company, Mutual Fund scheme held around 25.4 p.c and FII/FPI held around 13 %.

.

.

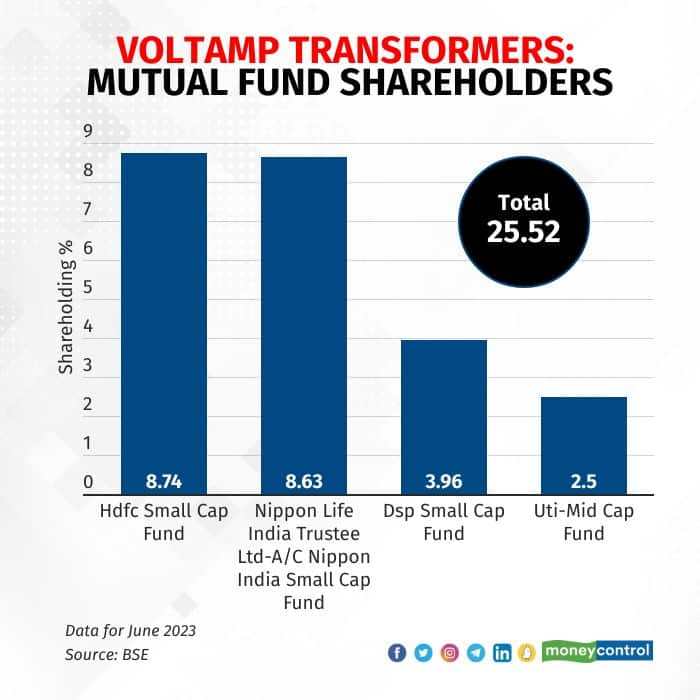

As for institutional traders, the variety of mutual fund schemes within the stock has expanded to nine from seven in the April quarter. similarly, mutual fund holdings in Voltamp Transformers have fallen from 25.fifty two-25.forty percent, as per June 2023 data. at present, Nippon India Small Cap Fund – growth, HDFC Small Cap Fund boom and DSP Small Cap Fund regular Plan boom are the biggest mutual fund shareholders within the stock. From March 2023 quarter to June 2023 quarter, while HDFC Small Cap Fund and Nippon India Small Cap Fund haven't elevated or lowered their holdings, DSP Small Cap Fund holdings have extended from 3.ninety six percent to four.forty one percent.

.

.

stock call: amazing company outlook, confident administration

Analysts continued to be mainly positive on the inventory because of a strong business outlook.

Prabhudas Liladher's Amit Anwani and Nilesh Soni, in a September 2023 report, said that they are superb on the stock because of its market place in industrial transformers, mighty enterprise mannequin, debt-free steadiness sheet, constant free money stream generation, and a in shape enquiry pipeline.

The brokerage raised the target rate to Rs four,611 from Rs 3,961 previous, valuing it at a PE of 20x FY25E, up from 18x earlier, due to the enhanced enterprise outlook. The enterprise continues to have a 'grasp' call on the stock.

For the quarter ending June 2023, Voltamp said a 19 percent YoY growth in income to Rs 322.19 crore. Its profits earlier than interest, taxes, depreciation and amortisation (Ebitda) margin also grew 150 groundwork aspects yr-on-year to 14.9 p.c for a similar length. net profit for Q1FY24 become Rs 50.8 crore up 90 percent from the previous fiscal.

sure Securities analysts keep a 'purchase' ranking on the inventory after the robust Q1FY24 with extent-led earnings boom and a decadal excessive Q1 EBITDA margin, aided by easing of commodity charge pressures amidst a powerful demand ambiance. The order publication of Rs 1,one hundred ninety crore (up 61 p.c YOY) executable for the entire year, in line with yes Securities, augurs well for the business's near-time period revenue and margin efficiency.

but they introduced that whereas the order publication momentum is expected to maintain, the competitive intensity has expanded peculiarly in reduce voltage classification transformers, leaving little room for margin growth in the close time period. yes Securities raised the goal fee to Rs 5,836 from the previous Rs 4,779. Analysts have additionally revised their income estimates for FY24 and FY 25 factoring in a continued suit demand outlook, normalising the supply chain (CRGO lamination) and increasing utilisation of their Savli plant.

The management continues to be positive in regards to the business outlook due to steady growth in domestic demand from metals, statistics centres, eco-friendly power, pharma, automobiles, and many others, say analysts. For the fiscal, the company is additionally searching in opposition t the export markets once again after a gap of two years as a result of logistical challenges. they're going to also be focused on markets like Africa and Asia.

The Vadodara-primarily based enterprise with a market cap of Rs 4,986.22 crore, currently has two flowers found in Makarpura, Vadodara and Savli, Vadodara in Gujarat.

As of 10:fifty eight am, on September 26, stocks of Voltamp Transformers were buying and selling at Rs 4770.35, three.21 % reduce than its shut on September 25. Over the last 12 months, the inventory cost has won over 88 %.

Disclaimer: The views and funding assistance expressed through investment experts on Moneycontrol.com are their own and not these of the web site or its administration. Moneycontrol.com advises clients to check with licensed consultants earlier than taking any investment decisions.

Comments

Post a Comment