equity mutual dollars outperform friends in Nigeria’s N1.87 trillion mutual fund market

equity-concentrated funds have tested superior efficiency in comparison to fastened-salary-based mostly cash within Nigeria's thriving mutual cash business, valued at N1.87 trillion.

in keeping with records analyzed by means of Nairametrics, a big variety of fairness-based funds completed returns that surpassed the inflation rate right through the first half of the year.

These money signify collective investment schemes that primarily goal Nigeria's inventory market.

The protection and change commission, liable for monitoring and reporting on the mutual fund markets, identifies 134 such dollars currently working within the nation.

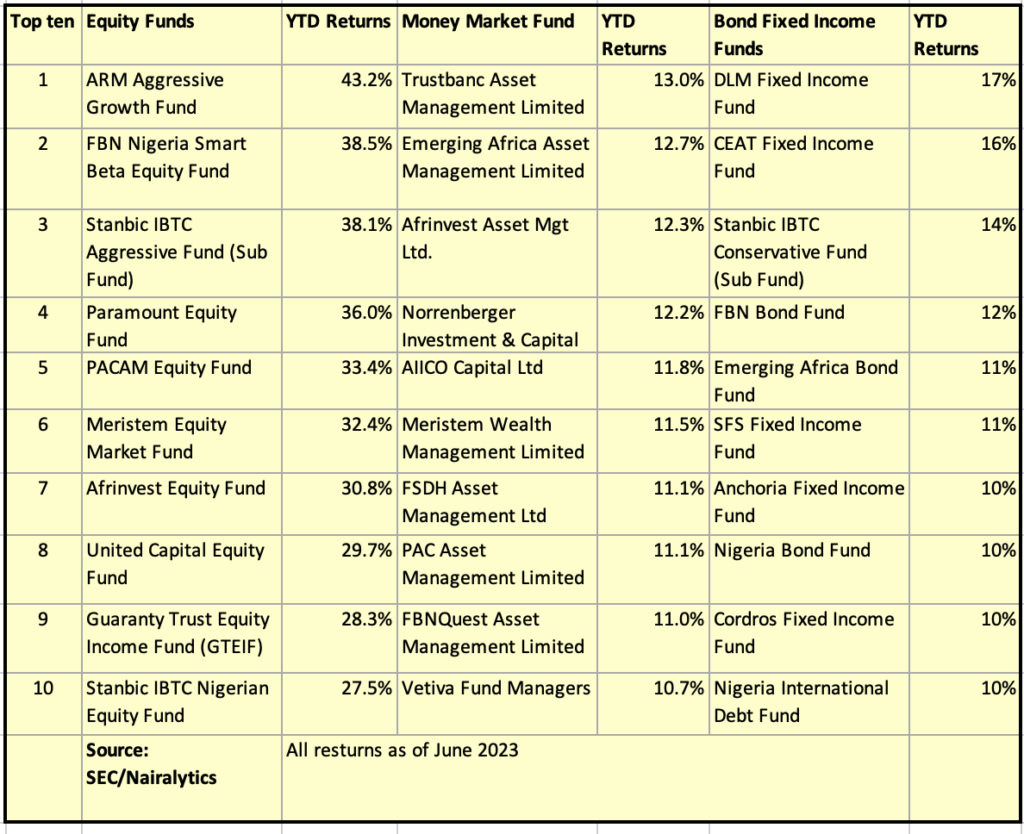

Fund performancefairness-based mostly cash: amongst these money, sixteen are categorized as fairness-primarily based, boasting a combined web asset price of N20.5 billion. Impressively, all of those money recorded double-digit 12 months-to-date returns.

The dazzling efficiency of the fairness-based mostly cash is aligned with the universal performance of Nigeria's Equities market, exemplified by means of the NGX All Share Index, which has skilled a awesome 23% yr-to-date benefit, attaining the 2d-maximum index element ever recorded at 63,040.

funds Market cash: Relative to different types of funds, equity-primarily based cash have verified sophisticated efficiency, closely following the first-rate performance of the equities market.

The funds Market money, with a total net asset cost of N817.5 billion, constitute about forty three.6% of the overall N1.9 trillion mutual fund market.

other money: Bond/fastened salary funds, in spite of this, dangle a value of N327.5 billion.

in addition to fairness-primarily based dollars, change Traded funds (ETFs) exhibited super performance in terms of yr-to-date returns.

above all, VCG ETF, VETBANK ETF, Meristem price ETF, and SIAML ETF forty executed fabulous returns of fifty two%, 51.7%, forty nine%, and 39.6% respectively.

youngsters, regardless of their miraculous performance, the collective web asset price of those ETFs remains rather modest, amounting to just N8.7 billion.

Comments

Post a Comment