Day full of vital macroeconomic information and company outcomes

Thursday's session become a session wherein many businesses offered their quarterly results for the second quarter. among these enterprise consequences, the highlights blanketed the likes of Intel, Twitter and AT&T.

simply a number of days ago, we commented that Intel could be drawn to buying GlobalFoundries as some rumours and media retailers brought up and that quarterly consequences might provide impetus to this action. specially, Intel introduced positive effects the previous day by which revenue per share reached $1.22 together with salary of $18.fifty three billion versus $1.07 per share in earnings of $17.8 billion expected with the aid of market consensus.

Twitter additionally posted positive quarterly consequences after revenue per share of $0.20 and income of $1.19 billion versus $0.072 per share and earnings of $1.06 billion anticipated. These outcomes are being welcomed by the market, given that in the meanwhile all over the pre-open the price rises more than 5%.

For its half, the telecommunications massive AT&T also introduced fantastic outcomes that would attract the attention of buyers, after signing its agreement with Discovery for the merger of this with WarnerMedia. In these outcomes, we are able to see that because of HBO Max and its streaming capabilities, besides the two.8 million subscribers that WarnerMedia bought, the enterprise obtained 798,000 new mobile subscribers some distance exceeding market estimates.

in particular, AT&T, earned salary per share of $0.89 and profits of $44.05 billion versus $0.79 per share and expected revenue of $forty two.sixty six billion.

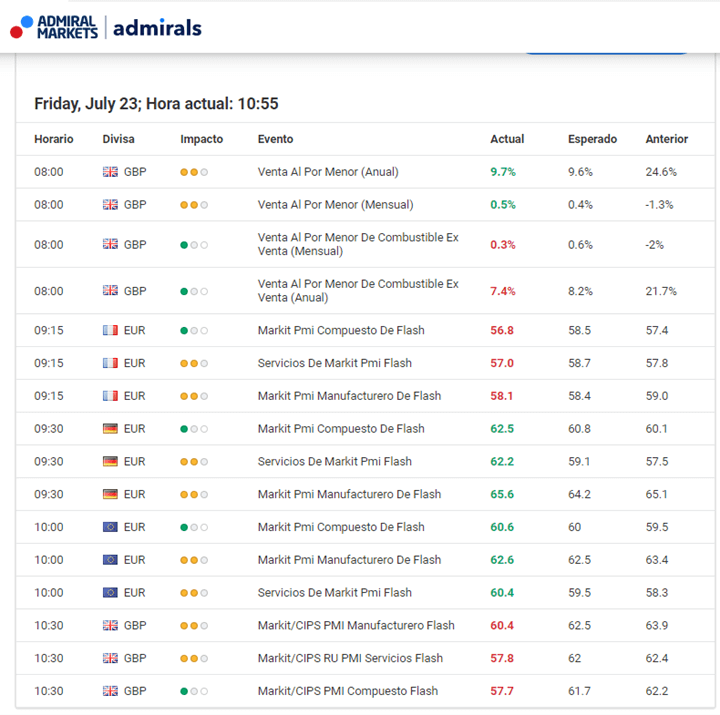

even so, all over the beginning of cutting-edge session, we realized the preliminary PMI data for the capabilities and manufacturing sector for France, Germany, the United Kingdom and for the euro enviornment as a whole. while Germany and the Eurozone have surpassed market expectations, the united kingdom and France have performed worse than expected.

supply: Admiral Markets currency trading Calendar

supply: Admiral Markets currency trading Calendar

We must bear in mind, that the manufacturing PMI is a trademark designed to deliver suggestions on the financial exercise of the manufacturing sector the place a outcomes above 50 suggests enlargement and increase of this business.

For its half, the PMI of the features sector measures economic undertaking through the purchases made during this sector. As in the manufacturing PMI, a reading above 50 is considered nice suggesting first rate future potentialities, whereas a studying under 50 is regarded poor.

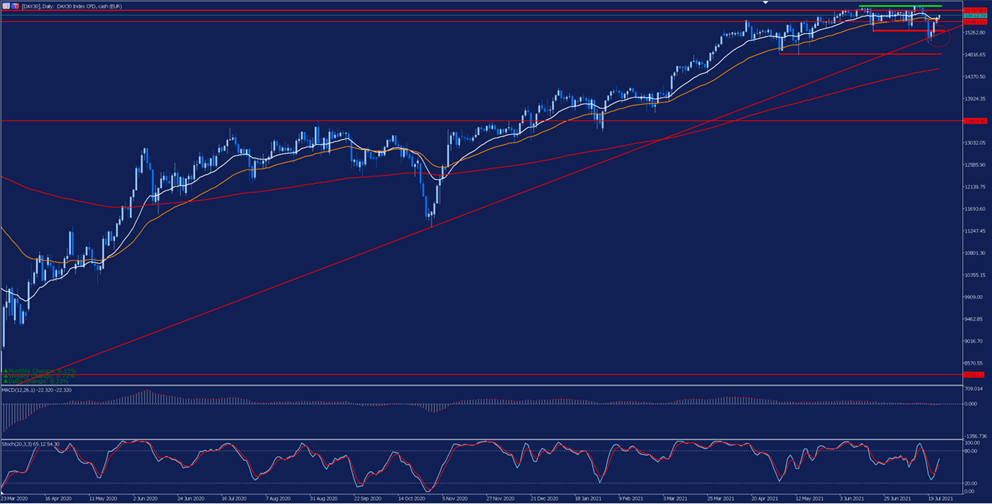

These effective consequences for Germany, can provide a boost to the DAX30, when you consider that if we appear on the each day chart we can see that after bouncing within the important aid area coinciding with the lessen band of the facet channel and the uptrend line represented by way of the purple circle, the price has received a new bullish momentum that has led it to surpass its 18 and forty session moving averages bigger.

supply: Admiral Markets MetaTrader 5. Dax30 daily Chart records latitude: March 23, 2020 to July 23, 2021. prepared on July 23, 2021 at 10:50 a.m. CEST. Please notice that previous returns don't guarantee future returns.

supply: Admiral Markets MetaTrader 5. Dax30 daily Chart records latitude: March 23, 2020 to July 23, 2021. prepared on July 23, 2021 at 10:50 a.m. CEST. Please notice that previous returns don't guarantee future returns.

Evolution in the final 5 years:

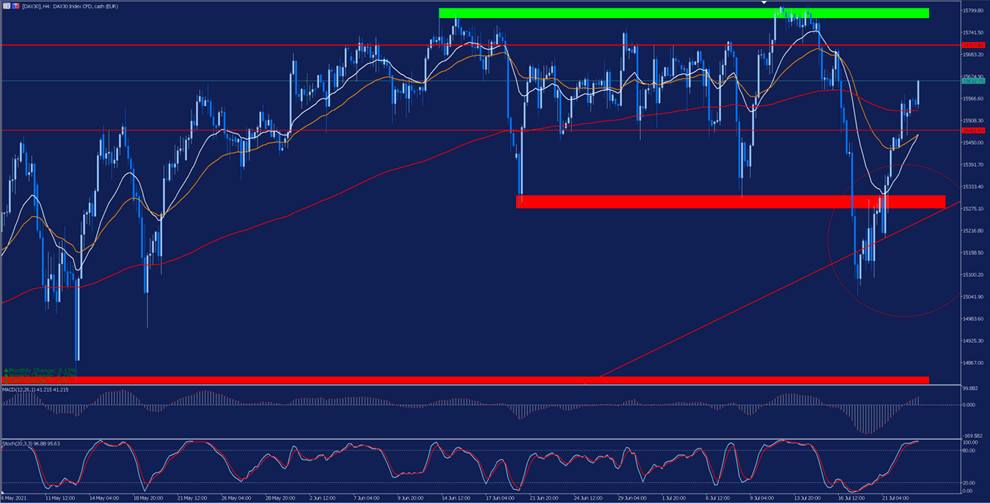

On the H4 chart, we are able to see that the enviornment of its 18-session relocating typical (white) on the day by day chart corresponds to its 200 relocating typical on H4 (crimson) and that the rate has strongly passed this essential resistance stage after bouncing again on the help indicated above.

If we look at the stochastic indicator in this time body, we are able to see that it's currently at overbought ranges, so it isn't out of the query that the rate may retrace its existing supports at the 200 moving typical in H4 (which corresponds to its 18-session moving commonplace on the day by day chart).

In such a case, it would be critical to examine the conduct of the price at this degree, seeing that if it manages to retain it, we may find a bullish impulse to the upper facet channel enviornment in the eco-friendly strip.

provided that the cost doesn't lose its main support level on the every day chart represented by the crimson circle, sentiment will stay bullish. The lack of this degree would open the door to extra correction.

source: Admiral Markets MetaTrader 5. H4 chart of the DAX30 facts latitude: might also 6, 2021 to July 23, 2021. prepared on July 23, 2021 at 10:55 a.m. CEST. Please word that previous returns do not assure future returns.

source: Admiral Markets MetaTrader 5. H4 chart of the DAX30 facts latitude: might also 6, 2021 to July 23, 2021. prepared on July 23, 2021 at 10:55 a.m. CEST. Please word that previous returns do not assure future returns.

With the Admirals alternate.MT5 account, that you could exchange Contracts for transformations (CFDs) on DAX30, Twitter, Intel, AT&T, and greater than 3000 shares! CFDs permit traders to try to cash in on the bull and bear markets, as neatly because the use of leverage. click on the following banner to open an account these days:

guidance ABOUT ANALYTICAL materials:

The given information provides more information related to all evaluation, estimates, prognosis, forecasts, market stories, weekly outlooks or different similar assessments or assistance (hereinafter "analysis") published on the websites of Admiral Markets investment corporations operating beneath the Admiral Markets trademark (hereinafter "Admiral Markets") earlier than making any funding selections please pay close attention to here:

Comments

Post a Comment